We help escorts develop a long-term financial solution for the coming decade of increased digital control, regulation, and surveillance. When working with asset protection to mitigate as much risk as possible, we implement at least two layers of ownership with a wide geographic spread and the use of agent and trustee services. As the ownership chain gets longer, the probability decreases that any single link’s vulnerability compromises the entire ownership structure. The wider the geographic spread, the more likely that at least one jurisdiction won’t disclose your personal details. Finally, professional agents and trustees may conceal you as the legal owner.

Why is offshore better than onshore?

- An offshore entity is simply a company that is established in a country other than the one where your business operates or where you reside.

- Although a domestic company is cheaper to set up, and does not need to deal with foreign laws, regulations and reporting requirements, it does not offer complete protection from domestic creditors and courts. It is still subject to domestic laws, which means that a judge could order you or your trustee to turn over your assets to satisfy a claim against you.

- Meanwhile, your domestic country has less influence over offshore companies. It offers superior protection from domestic creditors or courts. Certain foreign countries have more favorable and flexible asset protection laws.

- To give you the best protection, creating an offshore asset protection trust may be the best option. The trustee of an offshore trust doesn’t have to follow the laws or orders from your home country. This means the trustee company can say no to foreign creditors or courts trying to take away your assets.

- Another benefit is that offshore companies create a significant deterrent for domestic creditors. It is much more costly and difficult for them to pursue a claim against you or your company. Foreign lawyers, travel expenses, and they must prove their case under a different legal system (Cook Islands and Nevis require proof beyond a reasonable doubt). Also, they only have a very short amount of time to bring their action into courts. Once the statute of limitations expires, the courts won’t even hear the case- they will turn it down. Most creditors end up settling for less, or give up all together, rather than going through an expensive and time-consuming hassle.

Offshore LLCs: At Asset Protection Advisers, we suggest clients to incorporate offshore LLCs to operate bank accounts, where the LLC manager is you. The key to our long-term strategy is to compartmentalize assets into their separate legal entities, and to always separate your company and bank account across different jurisdictions. This separation acts as a safeguard against potential threats, such as a Mareva injunction, which freezes assets, or the forced dissolution of the company.

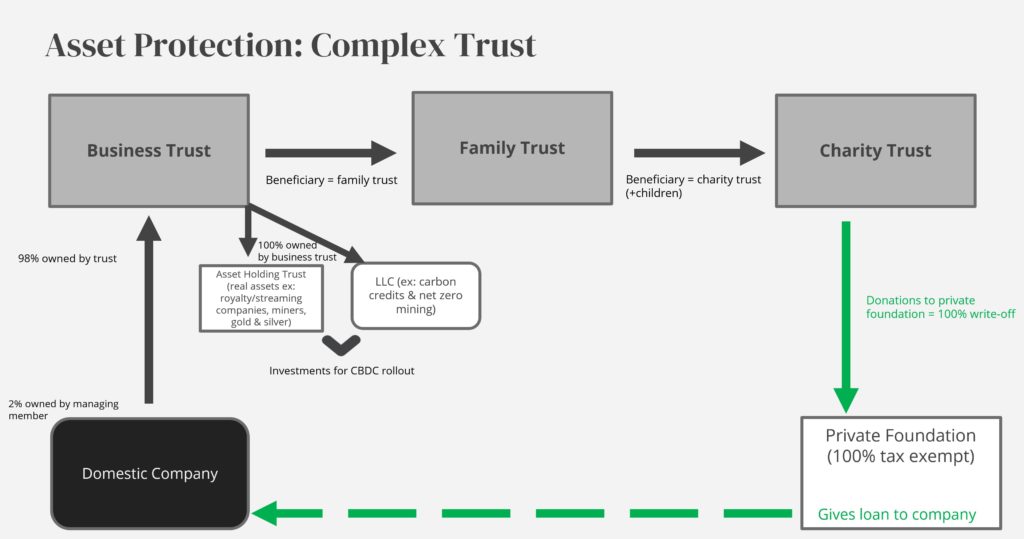

Complex Trusts: In certain situations, we compartmentalize trusts based on their use cases to build a philanthropy structure. Since donations are tax exempt, our solutions offer legal ways to significantly reduce taxes through accounting, loan restructuring & wealth transfers.

Modern Asset Protection Challenges

Mareva injunction: also known as a freezing order or a “temporary restraining order”. It freezes assets in a trust pendin the outcome of a trial. This injunction permits a creditor to obtain a court orders freezing assets of an Asset Protection Trust. Once trust assets are frozen, the trustee and settlor often don’t have the financial resources to challenge the creditor’s action in court, meaning that the creditor has won the war without ever having to go to battle.

- This is why at Asset Protection Advisors, we make sure to build complex trusts with Change of Trustee and Situs of Administration clauses where assets can be transferred from one jurisdiction to another in the event of duress.

Paper Trusts: these are jurisdictions that lack the geopolitical capability to hold and safeguard trust assets. We make sure to take into account the country’s geographical location, their foreign influence, as well as the case law and historic customs when developing an asset protection plan.

Fraudulent Conveyance: it’s the act of transferring assets to your trust to intentionally defraud creditors. For example, let’s say you have a house and someone sues you. If you transfer the house to the trust the next day, the court will accuse you of a fraudulent transfer; i.e. you cannot hide behind the argument that you don’t own the asset and that the trustee owns it- the court will say the transfer was in bad faith.

- At Asset Protection Advisors, we avoid fraudulent conveyance with four strategies. First, certain jurisdictions have short statute of limitations for fraudulent conveyance cases to be brought to court. Second, fraudulent transfers are civil, not criminal cases. In a successful suit, the courts entitle the creditor to recover property that the debtor transferred. Finally, the burden of proof in many offshore jurisdictions is beyond a reasonable doubt, meaning that they have to prove to 95%-97% certainty that the reason you transferred assets to the trust was not to avoid any creditor, but specifically from the creditor filing the lawsuit. This is difficult to prove beyond a reasonable doubt, since the defendant can say that they established the trust for any other reason than “the trust was set up to protect assets from creditors”. Instead, legitimate purposes may include “diversifying investments internationally” or “establishing a legacy for generations”.

Controlled Foreign Corporation: This mainly applies to U.S. citizens and residents. After President Trump’s Tax Cuts and Jobs Act in 2017, there were big changes in how the IRS treats income from foreign companies that American shareholders own. This affects trusts too. If a company has over half of its owned by Americans, it’s seen as a Controlled Foreign Corporation (CFC). The IRS then taxes shareholders as if they got dividends from that company, even if they didn’t.

- At Asset Protection Advisers, we help our U.S. clients structure themselves as indirect owners of a CFC, while complying with the 2021 Corporate Transparency Act.